Product Description

Problem we’re trying to solve

Cashflow forecasting and management is one of most essential contributors to business success because it should inform sound and confident business decision making. It’s well known that poor cashflow (and decisions made using a poor cashflow) can kill businesses.

Most businesses use Excel for cashflow forecasts, which “kinda works”, but is not ideal because it:

- is too manual and time-consuming to keep updated with actuals as they occur

- is too prone to mistakes in formulas that could have a considerable negative impact

- uses high level best guess assumptions (like a debtor’s profile) which may be out-of-date and/or disconnected from today’s reality.

Because of how time consuming it is to update actuals into the cashflow model, at best businesses are updating their cashflow monthly.

In an ideal world, businesses would have an up-to-date and real-time cashflow forecast all the time (whether it is for the next week, next month, next 3 months and/or next 12 months) that reflects both actuals as they occur and budget, with minimal or no manual intervention.

Product Overview

The AppsForGreentree Cashflow Forecasting app resolves these problems and challenges, and delivers the ideal world solution; real-time, up-to-date, available 24/7 and reflects what’s happening in the business day-to-day and hour-to-hour without the need for manual intervention.

Our AI and machine learning-based technology creates future cashflow projections to support confident financial decision making.

The starting point for the cashflow forecast is the budget or forecast, which we use as the best guess of what the company’s future financial and cash performance is most likely going to look like. The cash timing of the budget or forecast for each GL account, as well as the GST impact, is automatically calculated using the historical data for that account.

Then, as better information and predictors of future performance and cash timing become available (such as invoices, sales orders, backorders, forward orders, purchase orders, shipment updates, sales forecasts, proforma invoices, quotes, etc within Greentree), these transactions are put into the cashflow as actuals and the budget is consumed/reduced accordingly.

In the absence of a budget or forecast for any future period you’re wanting to forecast cash for, you may choose to tell the AI to look at some combination of prior periods to be the predictor of performance for that period. Then, when a budget is later created, this will override the use of the prior period history.

Because of this high level of integration with the operational Greentree modules, the cashflow forecast needs no manual updating by accountants, other than to include items that have no budget or actuals in Greentree, or what-if/planned items. The cashflow forecast is dynamically and iteratively updated from the day-to-day use of Greentree by the operational people in the business doing their day job, whether it be creating new Purchase Orders, updating expected delivery dates for purchase orders and shipments, invoicing, liasing with customers over outstanding invoices, or making payments and receipting cash.

Truly AI driven cashflow forecasting.

Features and high level examples

- Budget or forecast. Typically budgets (or forecasts) are created at a GL account level, and then have a corresponding cashflow forecast based on high-level assumptions. Our model looks at a user-defined time period (like last 3 months, last 6 months, from todays date or same date last year) and builds what the actual cash profile looked like for a GL account, and then applies that to the budgeted value for a period. As transactions occur that consume that budget, the budget is reduced accordingly as the actual transaction will now have its own cash profile based on either the customer/supplier terms or history, or specific one-off terms that may have been negotiated for that transaction.

- Accounts Receivable. Typically, people will forecast cash components from AR using the balance sheet as their primary point of reference. They calculate AR days and apply this number to generate a future AR balance based on forecasted sales. Then, they look for changes in AR to translate into future cash inflow. Others might take payment terms (upon receipt, NET 30, NET 60 etc.) into consideration and apply them to outstanding invoices in an effort to estimate when cash is likely to come in. These approaches are high-level and depend on several proxies and very generic assumptions about the inputs pertaining to cash flow. Creating forecasts using this approach is also very time-intensive. Instead, our model looks at a customers payment history to more accurately predict when they will pay their outstanding invoices, and if they don’t pay based on that forecast, they are changed to not forecasted until operationally someone moves them back in when they have better information. Additionally, operational staff can update the forecast date of individual invoices – including split terms – based on special terms that might have been negotiated.

- You can create any number of scenarios to model what-if analysis. Scenario’s may include assumptions around dividends, capex, exchange rate movements, slower debtor collections or just a different budget version and can be overlaid on top of your base case to understand the effect.

- Manual non-ERP transactions can be created in the Cashflow model to reflect transactions that aren’t in the budget/forecast, whether it be dividends, drawings, capex, etc. These can update the base case forecast, or be held separately in a what-if scenario. Those manual transactions can be flagged to be auto-matching so that when the corresponding actual transaction is created (based on user-defined parameters like within x days, within x%, specific transaction types), it is removed from the forecast.

- The App pulls through not just customer and supplier invoices, but also sales orders, backorders, forward orders, purchase orders, shipments and job cost and revenue.

- The cashflow forecast can be viewed by month, by week, and even by day, with the ability to see the transactions or budget item that make up the movement for the period.

- Bank accounts can be consolidated, even across companies, to give a company-wide view of the cashflow.

- GST is automatically added to budget items based on the historical data, and any payment/refund to the IRD/ATO for that GST is included in the cashflow based on the companies tax due dates.

- The data can be exported to Excel for customer specific reporting requirements.

- In the future, the goal is also to enable the user to compare multiple forecast models at the same time and to be able to compare historical forecast snapshots with the historical actuals for the same period to drive towards giving confidence in what is being forecast today.

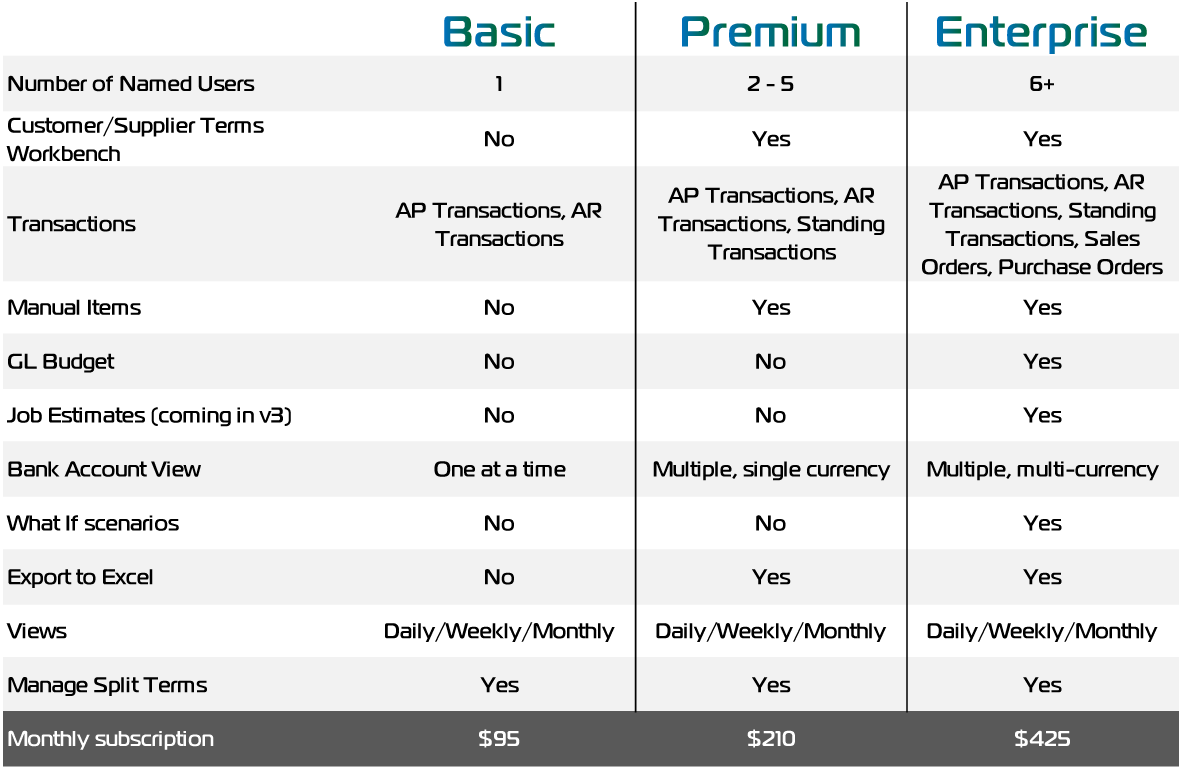

* Named users : access to the Customer Terms Workbench, Cash flow Analysis and cash flow forecast tab on the customer and supplier to update it.

New Zealand Dollars

New Zealand Dollars

Australian Dollar

Australian Dollar

Great British Pound

Great British Pound

US Dollar

US Dollar